Articles Workers Compensation

If you have been injured at work you may be entitled to claim workers compensation. Please continue reading gain a better understanding of how the process works and a few tips on what you should do if you find yourself in this situation.

What is Workers Compensation Insurance?

Most employers in Australia are legally required to have Workers Compensation insurance. This policy covers the costs incurred by an injured worker as the result of a work related injury. This is a “no-fault” scheme meaning, if you sustained an injury as a result of an error on your part you will still be covered. The rules differ slightly in each state, we will be discussing the NSW system.

Who is Covered?

If you are working for an employer you should be covered under their workers compensation policy if:

- You have sustained a physical or psychological injury as a result of performing your work duties. This includes frank incidences (i.e. fall) and repetitive strain injuries (i.e. prolonged sitting at a desk).

AND

- You are an employee of a business. This includes full time, part time and casual employment arrangements. Please note: employees can be covered even if their employer is uninsured.

- You are a volunteer of a state government agency. This includes Rural Fire Services, SES, Marine Rescue, Surf Life Saving and Volunteer Rescue Association.

Are Sole Traders and Contractors Covered by an Employers Policy?

Depending on your employment arrangements, sole traders and contractors may be covered by an employers policy. However, this is dependent on several factors and needs to be assessed on a case by case basis by the insurer.

What Benefits are You Entitled to Under Workers Compensation?

- Your injury will be managed under NSW Workers Compensation Law. Certain procedures need to be adhered by all involved parties (i.e. employer, insurance company). This offers you a degree of protection and course of action should you be treated unfairly (i.e. insurer declining recommended treatment).

- Receive weekly payments or top ups in the event your are not able to work your normal hours or require time off work. Please Note: If you have an accepted claim any time taken off work should not come out of your sick leave or annual leave entitlements.

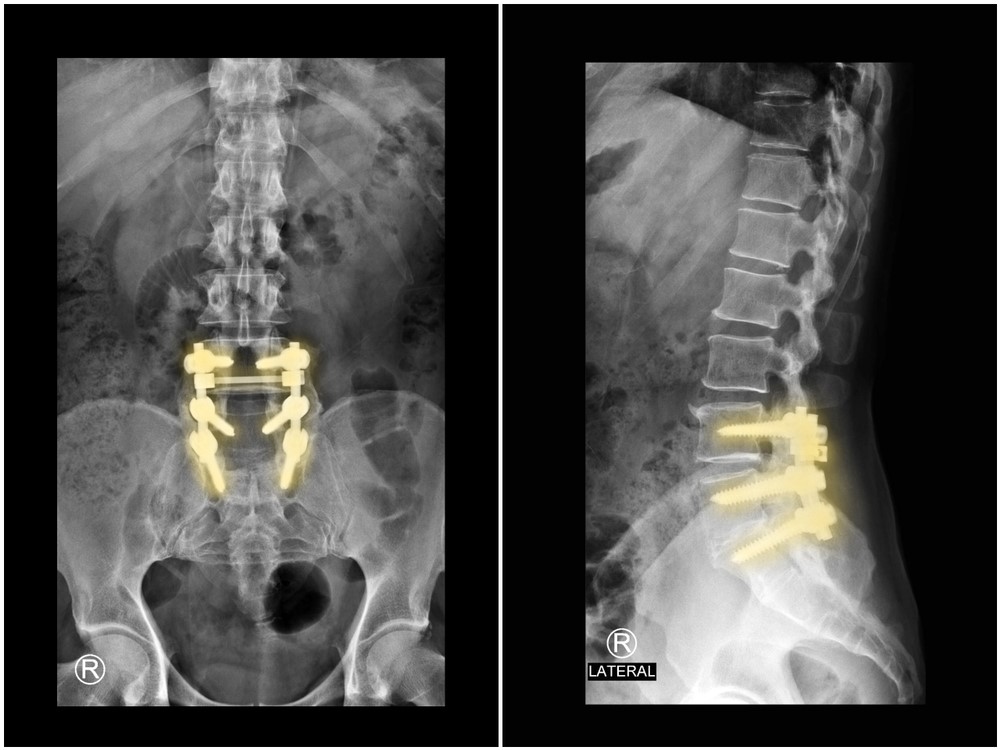

- Coverage of medical and hospital related expenses, this can include hospital, GP and specialist fees, scanning and procedures (i.e. cortisone injections, surgery).

- Rehabilitation costs (i.e. physiotherapy, psychology, hydrotherapy, equipment).

- Travel costs associated with your claim (i.e. travelling to medical, hospital and rehabilitation appointments).

- Domestic assistance in the event your are unable to perform these duties as a result of your injury (i.e. cleaning, gardening).

- Assistance with returning to work at your previous job.

- Assistance with finding new employment in the event you are unable to return to your previous job.

- Lump sum payment in situations where you have a permanent impairment as a result of your injury (i.e. your injury required surgery).

Why Would You Decide Not to Make a Workers Compensation Claim ?

Lodging a work cover claim can be stressful at times. You will have to weigh up the pros and cons of your specific situation. Some people do not to lodge a claim for the following reasons:

- they are not aware they can claim workers compensation

- can be confusing and stressful dealing with the paper work and claims processes

- “my injury is not that bad, I’ll deal with it myself”

- fear of offending your employer

- fear of being looked at unfavourably by your coworkers

- fear of jeopardising your current and future employment

- financial loss (i.e. inability to work over time shifts)

How do I Lodge a Workers Compensation Claim?

Following an injury you should notify your employer as soon as possible. You will then need report your injury to your nominated treating doctor who should issue you with a worker cover certificate. The information will be forwarded to the insurer and they will make a decision on whether your claim will be accepted or not.

What is a Work Cover Certificate of Capacity and Why is it so Important?

This document reflects your ability to return to work. It should be filled out in conjunction with your NTD. The information provided on this certificate needs to be carefully considered as it can affect your payments, what treatments are approved and whether your claim is approved or not.

Why is Having a Good Nominated Treating Doctor (NTD) so Important?

Your NTD is typically a GP, they are responsible for:

- updating your work cover certificate

- communicating with your insurer, employer and all other parties involved in your treatment.

- recommending what treatments/services you require to facilitate your recovery (i.e. physio, scans, specialist, domestic assistance)

- medically managing your injury

It is important to choose a supportive NTD who you are comfortable with. In addition to being a good GP, they need to have a good knowledge of the workers compensation system and be an advocate for your best interests. This can take a a lot of stress out of a claim so that you can focus on your recovery.

What is a Rehabilitation Provider and What do They do?

In the event your injury is progressing slower than expected or you are encountering difficulties returning to work, your insurance company may assign a rehab provider to your case.

Their role is to:

- liaise with your insurer, NTD, employer and your support team (i.e physio, psychologist) to assist you with returning to work

- formulating a return to work plan

- assess your work place to identify suitable duties (i.e. office duties)

- address barriers restricting you from returning to work (i.e. modifying your desk setup)

- organising domestic assistance when required, this may involve an assessment of your home

- conducting specialised assessments to review your skills and ability to work

- assist with finding new employment in the event you are unable to return to your previous job

Their role is not to:

- determine what is written on your work cover certificate

- coordinate what treatments you require for your recovery

What is the Insurance Company’s Role?

The insurer will assign a case manager to oversee your claim.

Their role is to:

- assess whether your claim is approved or not

- manage your payments

- manage and approve your treatment and rehabilitation needs

- organise assessments in the event they require more information (i.e. independent doctor assessments)

Their role is not to:

- determine what is written on your work cover certificate

- coordinate what treatments you require for your recovery

Your are Entitled to Choose Your Own Support Team!

Unfortunately, claims do not always go smoothly, having a good support team will ensure your best interests are looked after. You are entitled to select your own treaters (i.e. NTD, physio, psychologist, specialist) and change if necessary. This also includes your rehab provider.

What do I do if I Have Issues With My Claim?

It is a good idea to firstly speak to your NTD or one of the members of your treatment team. Sometimes, simple issues can be quickly resolved by clarifying communication errors or by explaining how the work cover processes operate.

For more difficult issues it is always best to contact the Independent Review Office (IRO). This independent government agency has been set up to provide assistance for injured workers who are:

- having disputes with their insurers

- requiring legal advice

- requiring clarification of the work cover processes

IRO can be contacted via this link , you can also visit their website here

Please keep in mind the information provided is general in nature and should not be used as a substitute to consult your treating health professional. If you have any specific questions or require assistance with your individual circumstances please do not hesitate to contact My Family Physio in Mona Vale.